Insurance sales is a unique industry - from rising inflation, interest rates, and the looming threats of recession, plus competition from Insurtechs, insurance can often feel like fighting an uphill battle. While industry hurdles can often lead to turnover, every sales team struggles with retention, and insurance is no exception. In fact, many insurance teams we have talked to reported annual turnover rates up to 80%.

So, how can you retain your top talent so that you can have an informed, motivated, and intelligent sales force and cut back on recruiting and training costs? Let’s dive into the numbers and what we’ve learned over the last few years.

What is retention in insurance sales teams?

In insurance sales, retention is all about keeping your sales reps on board. This means creating a supportive work environment where they feel valued. Offering opportunities for career growth, competitive compensation, and recognition all contribute to this. By focusing on retention, you can reduce turnover, boost employee satisfaction, and ultimately improve your overall sales performance.

1. Understand your Team

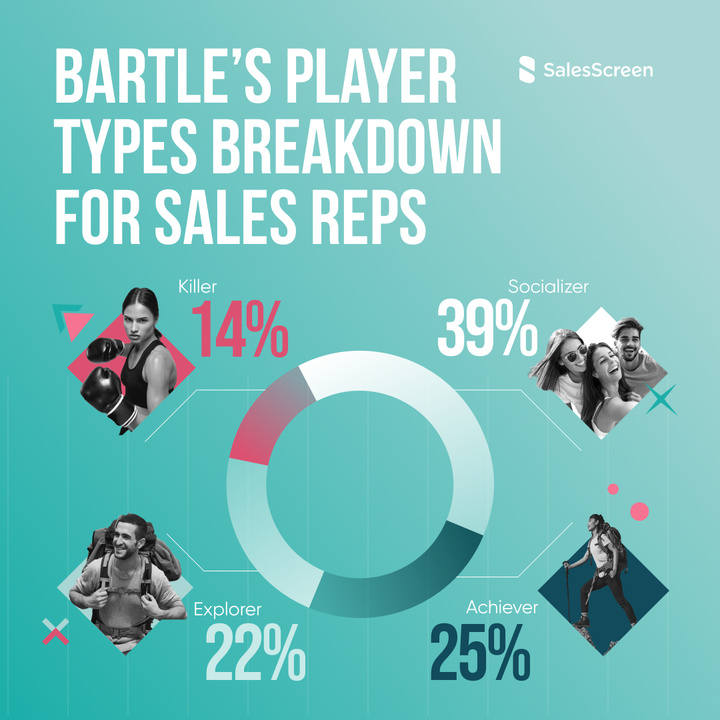

The most important step for any sales leader looking to boost productivity and retention in the insurance industry is to understand who actually makes up your sales team. To truly understand this, we turn to renowned psychologist Richard Bartle. Bartle breaks down people into four main groups: killers, socializers, achievers, and explorers.

Killers are oftentimes considered the best sales reps as they are intrinsically motivated, competitive, and bring that fire into every workday. But killers only make up ~1% of the workforce. Socializers, on the other hand, like to work on group projects and achieve team goals and make up a massive 75-80% of the workforce.

Each group is motivated differently and has different strengths, so it is important to take the time to get to know what drives your team to goal. Once you get to know the personalities and motivational styles of your sales team, you can really start to understand the right competitions, tactics, and incentives for your insurance sales team.

2. Incentivize Greatness

Incentives are the key to sales retention in the insurance industry, especially when top reps can easily clear six figures of bonuses in competitive spaces. Once you’ve got a good understanding of who is on your team, you can start offering rewards that actually incentivize great work and are tailored to your unique insurance sales team. After all, if you offer a great bottle of wine as a prize to a team that prefers tickets to the latest sporting event, you aren’t going to see any results. Try baking these incentives into daily activities like cold calls, outreach, or other crucial lead-generating activities. Even a 10% boost to these small daily activities can lead to massive revenue shifts.

3. Try Transparency

Every insurance sales rep likes to feel like they have agency and control over their daily workflow. The best way to do that is to be transparent with your agents, to give them access to daily competition data, and to show them how they are performing regularly instead of just at monthly reviews. Real-time data is one of the most powerful tools in any insurance sales arsenal. For example, traditional sales competitions have oftentimes been run on a simple whiteboard in the middle of an office.

Although this can be fun, your reps or agents have to stand up and walk over to the whiteboard just to see who is currently leading, and that number could be entirely wrong as certain reps won’t report a sale until the competition is about to close. When your insurance sales reps have access to real-time sales data, they know the moment someone has taken that number one spot. That creates a competitive environment that is healthy, sustainable, and non-combative.

Solving the retention problem

If your insurance sales managers are struggling to retain top talent, it might be time for you to get to the root cause of the issue and identify the pains of your insurance agents. Using gamification techniques will significantly improve your team's performance and keep them motivated at all times. Sales gamification gives you all the tools you need to incentivize, motivate, and retain top talent without making it your manager’s entire workday.